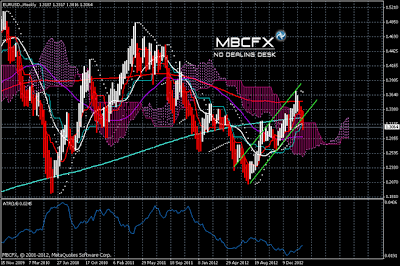

EUR/USD daily

forecast, would the Euro remains bullish or will shift to bearish?

/MBCFX/03/01/2013

EUR/USD

technical analysis by using the Down Kumo , Slop Line, the Ichimoku ,

FX5_Divergence MACD, and the Moving Averages indicators

http://www.mbcfx.com/news/news_en.html

The

EUR/USD witnessed a great volatility yesterday at 105 points, and has reached

the highest level at $1.3157, and lowest level at $1.3052, but it closed by a

bear candle,

And we

remain expecting further decline of the prices , especially after it has entered

within a Down Kumo trading , after it breached down the ascending

channel, and this confirms the decline of the EUR/USD towards the Ichimoku

support level of $1.2960,

and

the next target would be towards the 1.2906-1.2883 area, which would represent

a good opportunity to enter buy positions, because after that we expect the

EUR/USD would rise as an upward correction step. Which is indicated the

following 4 hours chart :

In

this chart, we notice that the EUR/USD is decreasing on the short term trading,

but we expect it would recover on the next trading session after reaching the above

mentioned levels.

The

following indicators: Slop Line, MACD, and the Moving Averages also give us

downward signals and support the bearish trend for the next trading session, then

upward signals on the average term trading.